You may have to bear with me a minute.

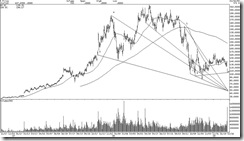

Many people remember the great NASDAQ crash of 2000. It happened in March. Internet stocks in particular were hit very hard – there had been a speculative bubble in the area – many companies went public with significantly unprofitable business models and promises of exponential growth in the future. Cisco was riding high, hitting a peak of 81. Though the stock took somewhat of a hit in March of 2000, it didn’t fall off a cliff – after dipping to below 50 briefly, it recovered to 69. Business was still strong, according to Cisco. Customers were taking all of the product they could manufacture. In fact, reporting their fourth quarter results in August of 2000, John Chambers said, "We see no indications in the marketplace that the radical Internet business transformation in practices like customer service, supply-chain management, employee training, empowerment, and e-commerce that is taking place around the world today is slowing -- in fact, we believe it is accelerating globally.” Reporting first quarter 2001 results in November, Chambers indicated weakness in the domestic CLEC market and expressed a more somber tone – visibility was becoming more difficult. Lucent had revealed some customer default issues and the company was dogged with questions about their customer base’s ability to pay. Though Cisco wasn’t having the same issues as Lucent, they were watching their receivables carefully. The stock dipped into the mid-40s and then traded back to the mid-50s over the next couple of weeks.

In December of 2000, Cisco revealed in their 10K that they were setting aside 275 million as loss provisions. A very small portion of it was to cover doubtful accounts. A larger part was to cover potential losses from investments. Half was to cover inventory reserves – they had extra parts on hand to fill excess customer demand. This was really the first indication of potential problems in their base and it was a pretty innocuous number relative to Cisco’s 25 billion dollar annual revenue run-rate at the time. The stock was 51 the day of the filing, but the spectre had been released – the stock became haunted by the notion that business was slowing and that their sales figures were likely bloated by sales to shakily-financed customers. By the time they were due to report in January of 2001, the stock was 34. Then came the big reset of expectations that ultimately took the stock to 16 by March. Between December, 2000 and March, 2001, Cisco stock was down 68%.

First Solar is in the vibrant solar power market and a lot of solar companies went public in the last year. They’ve been saying for several quarters that they can’t keep up with demand. They guided their sales down on a sequential basis after a particularly strong quarter. And now, they’re starting to talk about viability issues in their customer base – that 15% of their customers are at risk of default. This is likely the beginning of a problem for the company and not the end of one. Though the stock has retreated quite a bit from its highs, that doesn’t mean it has found its lows.

First Solar continues to throttle business as if it’s not slowing down – they’re saying they’re going to keep producing as quickly as they can and they will vigilantly watch for potential problems and scale back if they need to. This is ballsy. The proper thing to do is scale back and miss a little demand in order to avoid potential catastrophe. I think I have seen this movie before and it ends pretty badly. As financing problems are crippling all industries, I would submit that solar is not immune, despite government stimulus to promote alternative energy infrastructure. The internet infrastructure business was similarly strong in the face of a massive downturn in the IT space for a while… but not forever. It would not surprise me if First Solar is seeing the early stages of what will prove to be a significant slowdown.

Staying short FSLR.