The company reported better revenue and earnings but indicated 10-15% of their base could default. They’re very aggressively continuing to run the business as if there weren’t credit problems in the marketplace – in fact, they’ve loosened their payment terms to 45 days from the prior 10 days. It’s very likely this company will show deteriorating balance sheet statistics over the coming quarters. The stock is perceived as a prime beneficiary of the Obama administration’s well-known green-lean. Guidance was lowered to 1.8 – 1.9 billion from the prior 2.0 – 2.1 billion. I should have written this up yesterday but I was lazy and I don’t get paid to do this so there.

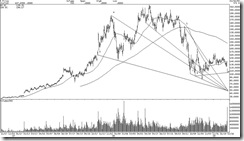

I expected to post a series of charts on the solar stocks suggesting that ENER, SPWRA and FSLR are all trading on the brink of important technical levels that must not be violated. The set of lines in this chart surprised me and point to the low 40s. Fundamental valuation would dictate that to be pretty much impossible unless something changes dramatically in their business or perceived accounting controls.

5 comments:

How did you come up with those seemingly random lines on your chart which are congregating all at $40.

What Technical Analysis Magic (or nonsense) are you using?

They're natural lines within the chart. It's neither scientific nor magical. I draw what I think I see. They can certainly be wrong and I invite you to send me your own technical work.

The last time I got flack like this about my lines was when I said the DJ would trade from 8200 to 7400. Interesting.

Sorry. It was 8500 in the DJ at the time. My bad.

http://theskew.blogspot.com/2008/10/i-dont-like-posting-this-chart-at-all.html

Actually I never doubted your call, only your lines drawn on your charts.

Last time I believe I said my 2 year old could draw better lines. Unfortunately I was being serious, but even more serious my kid is not that smart.

I do not see the natural lines you speak of, they look very random to me. Some have multiple points where they touch the trend line but points 4,7,6 and 3 are not valid trend line points.

I actually agree with you on FSLR, it is going down, but not because of your lines on the graph, there are many fundamental reasons.

I like your writing and hence I am a subscriber, and I am very impressed that you managed to get all the lines congregating at that one point like that. That is magical TA.

As for drawing my own TA lines, I do not see the point in doing that. You will be right on FSLR because the company is fundamentally screwed, not because of mine or your trend lines.

I'm the first one to admit that those lines are totally freehand and non-professional. The way I've always tried to find trend lines is by drawing a lot of them and seeing where there's some kind of repetition. I'm sure it's not the way it's generally done but I find when I treat the chart as a magical mystery tour I tend to get taken in unexpected places that I might not see otherwise.

In all honesty, when I started doing that chart I expected to draw one line of support at 105 but then I let myself get carried away, for better or worse.

I'll have another piece on FSLR tomorrow because you've got me thinking about it.

Post a Comment