Govt postpones stress test results till late Thurs afternoon. FT reports Citi and BAC are plotting to raise 10 bil a piece and that Wells Fargo and PNC are appealing initial findings that they require capital raises.

Buffett said he applied his own stress tests to WFC and thinks they’re just fine.

Buffett also said Berkshire Hathaway is likely to lose money on their credit default contracts, though he remains hopeful he will make money on his massive portfolio of index puts sold short.

Amazon is expected to unveil a larger format Kindle at a press event on Wednesday at Pace University, the 19th century headquarters of the NY Times – as the source here is the NY Times, I’m guessing their facts are correct. Industry watchers have this device pegged as tailored for large format print – newspapers. Could see Amazon stock do better into the announcement but the device is unlikely to save the newspaper industry.

China sets a deadline of May 15th for BIPV subsidy applications at $2.93 per watt with minimum installation volume of 50kw per project.

iSuppli predicts netbook growth may end when the economy recovers. This is a stupid theory – netbooks aren’t good primary computers but they’re great as a secondary. If anything, an increase in disposable income or a surge in corporate spending is likely to strengthen netbook shipments, not shrink them.

The Blackberry Curve outsold the iPhone last quarter, according to NPD. Keep in mind, these would be sales to consumers, not sales into the channel – cell phones are sold to carriers who in turn sell them to consumers. RIMM has an analyst meeting tomorrow where they are expected to unveil the Verizon version of the Bold. Two upgrades on Friday and Goldman throws RIMM on the conviction buy list this AM.

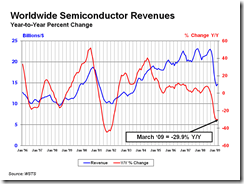

The Semiconductor Industry Association (SIA) reported sales jumped 3.3% m/m to $14.7 billion. Sales were down 15.7% from the prior quarter and 29.9% from the prior year’s quarter. Japan was the only worldwide region to contract in the period. Sounds a lot better than it looks:

No comments:

Post a Comment