Expect to walk in Monday and see that the Fed has come up with yet another quick fix for the ailing banks. Citigroup (C) and Bank of America (BAC) are clearly on the big huge trouble list as both stocks are in virtual freefall on fears they will be nationalized. Though I hope they can come up with something to soothe the markets, I don’t see what that would be as efforts to restore stability have not succeeded thus far and the option list continues to shrink. They’ve already taken rates virtually to zero, they’re already swapping bad paper for cash to help banks meet short-term commitments, they’re already guaranteeing commercial paper, savings accounts, bank issued debt. There can’t be much left in the Fed toolbox.

Confidence is extremely wounded in the market. The Dow Jones Industrial Average put in a 6 year closing low yesterday. If they close below 7400 I think you’re going to hear a lot of people talking about 6500.

Unfortunately, the cure for our ills remains time to work off the excesses of the last several decades. The system needs to be deleveraged. Policymakers have been pumping more air into the broken balloon for the last several months, which likely prolongs the downturn as further debt spending – spending our future anticipated revenue – only compounds the leverage within the system.

The dollar has been strong of late. This seems completely backward to me. Treating the dollar as a safe haven while its being so mercilessly diluted seems incongruent with reality.

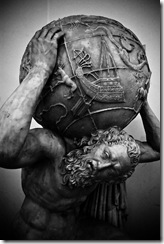

Good luck this weekend, Ben and Tim. You’ve got a lot of heavy lifting to do.

No comments:

Post a Comment