*

Goldman reiterates their sell on CRM, citing their small and medium business IT spending survey work suggesting enterprise seats overall will be down 1%. Prior survey indicated up 6%. Goldman believes renewal pricing rates are under pressure and that SAP’s upcoming earnings report will highlight the difficult enterprise software environment. Their target price on CRM is $23 (last sale $40).

*

Corning (GLW) reported better than expected gross margins – 27% vs expectations of 23%. While not providing hard guidance for 2Q, they said:

James B. Flaws, vice chairman and chief financial officer, said, "While economic uncertainty remains, we are expecting strong growth in display as our customers continue to ramp their capacity to match end market demand. We anticipate sequential volumes at our wholly owned business to be up more than 50% and up more than 25% at SCP. Therefore, we foresee relighting several of our glass melting tanks sooner than planned.

"With increased volume and manufacturing capacity," he continued, "we should see considerable improvement in both the display segment`s and the company`s gross margins in the second quarter." He noted that up through the end of the first quarter, Corning used existing inventory to meet the increase in glass demand. The company expects second-quarter glass price declines at both its wholly owned business and SCP to be much more moderate compared to the first quarter.

*

According to press reports, one unnamed bank was told to raise significant capital as a result of the stress tests.

*

Goldman is pushing Teradyne (TER) into the quarter, saying co will report in line w/ their preannouncement and guide revs flat to up for 2Q. They believe the bottom line will improve significantly as the company initiates radical cost restructuring and that there could be significant upside to 2010/2011 numbers. Goldman acted as manager for a recent offering by the company which is street speak for they may be full of it.

*

Swine flu makes me wish I had never read The Stand by Stephen King. Two guys in surgical masks on the train this morning. Very unsettling to see that. No edge here but expect airlines weaker and Gilead (GILD), maker of Tamiflu, strong.

*

DRAM and NAND spot prices drift lower – down 2% on average across most configurations.

*

Verizon (VZ) beat on a number of metrics. The CFO said he has never been more optimistic about ops. I really don’t like it when company officials say things like “never been more optimistic.” They often stumble shortly thereafter. While we’re on Verizon, USAToday reports VZ is near a deal to sell iPhones. Conversations are ongoing. This may just be a negotiating tactic on Apple’s part to extract better terms from AT&T.

*

Pakistan believes Bin Laden is dead.

*

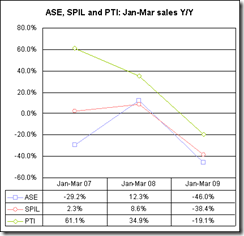

Chip packaging companies ASE and SPIL will see business rise 30% sequentially in 2Q with utilization rising to 50-60% according to sources via Digitimes.

50-60% utilization isn’t very impressive.

*

Netbook builds are on fire.

Current supplies of up-stream netbook parts and components are barely enough to meet 50-70% of market demand, with CPUs, LED parts and network ICs in severe shortage, said DRAMeXchange.

IC distributors reportedly plan to hike the prices of Intel's Atom, as well as VIA's C7-M CPUs by 5-10%, and prices of DRAM modules by 20-30% in May, the Chinese-language Commercial Times quoted market sources as indicating.

The tight supply is not expected to ease until the latter half of June, DRAMeXchange said.

Price hikes in Intel processors are extremely rare.

*

Goldman Sachs is using more leverage than ever for their trading operations.

*

Netease (NTES) will pay Activision Blizzard $565 mil over 3 years for the rights to World of Warcraft in China according to Pacific Epoch. That’s a really big number and would be very positive for ATVI if true.

*

No comments:

Post a Comment